In the vast landscape of mobile apps, some have managed to transcend their functional purpose and become love brands, cultivating deep emotional connections and unwavering loyalty. Instagram, Spotify, Airbnb, and Revolut are prime examples of apps seamlessly integrated into users' lives, becoming an indispensable part of their lifestyles. But what about insurance apps? Can they evoke the same emotional engagement and establish themselves as love brands? Let's explore this intriguing possibility.

Balancing Emotion and Reason

Lovebrands thrive on emotional aspects such as trust, authenticity, customer-centricity, innovation, and community-building. However, in the realm of insurance, where managing risks and financial protection take precedence, striking a balance between emotion and reason becomes crucial. Studies have shown that utility and functionality are the primary factors driving app installation and usage. Users seek apps that fulfill specific needs, provide useful functionality, and simplify daily tasks. So, can insurance apps cater to these utility-driven requirements while also appealing to the emotional side of users?

The Power of Trust and Care

While it may be challenging for insurance companies to achieve love brand status compared to sectors inherently invoking stronger emotional connections, trust is ingrained in their DNA. Insurance providers help individuals navigate through complicated life situations and demonstrate genuine care for their policyholders. By prioritizing personalized services, empathy, and exceptional customer experiences, insurers can forge stronger emotional connections, fostering loyalty and advocacy among their customers.

Uniting Reason and Purpose

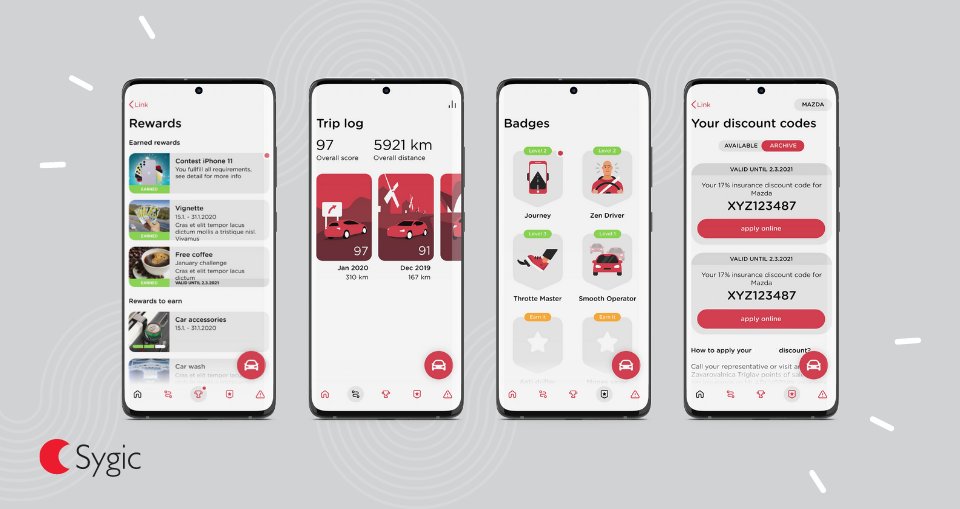

Insurance companies need to infuse their apps with reason and purpose to win customers' minds and their hearts. Let's consider a telematics app offered by a car insurer. The app rewards safe driving with fairer premiums based on actual risk by tracking the policyholder's driving behavior. Swift and simple claims handling and seamless communication with the insurer further enhance the app's utility. To please users' senses, a well-designed gamification system can be implemented, offering compelling challenges, meaningful rewards and incentives, and a sense of progression and feedback.

The Journey to Love-Brand Status: ConducTOP

An example that showcases the pursuit of becoming a love brand is ConducTOP, the telematics app offered by Spanish insurer Línea Directa Aseguradora. According to a study by Smartme Analytics analytics , ConducTOP ranked among the top 3 fastest-growing apps in the Spanish insurance market, surpassed only by its parent company's core insurance app. While ConducTOP is on its journey to love-brand status, it acknowledges that there is still a long way to go.

While insurance apps may face unique challenges in attaining love-brand status compared to industries with inherently stronger emotional connections, it is indeed possible for them to foster deep emotional engagement. By balancing utility and functionality with trust, care, and innovative features, insurance apps can transcend their traditional role and become love brands. The journey may be arduous, but with a relentless focus on providing exceptional user experiences, insurance companies can forge lasting emotional connections with their customers, ultimately becoming an integral part of their lives.

Ready to create your own car insurance app and embark on the journey to become a love brand?

Look no further! Sygic offers a white-labeled app solution that can have your app up and running in just a couple of months. Take the first step towards enhancing customer engagement, fostering loyalty, and standing out in the competitive insurance market. Contact us today and embark on an extraordinary journey.